travel nurse state taxes

Hello myself and my Fiance recently took hour first job as travel nurses in a town 70 miles from where we live. Here is a list of best states for nurses to work and live in.

How To Select A Travel Staffing Company Cariant Health Partners

If you have questions about which states you will owe taxes in its advisable to contact a CPA or.

. When I try and look up the GSA rate for this location I. This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you can think of these as travel expenses. 20 per hour taxable base rate that is reported to the IRS.

These states may be more attractive to travel nurses for this reason. The goal of a good tax preparer isnt simply to prepare a historical document which is the real substance of a tax return. To relieve the potential doubling up on the tax the home state will allow a credit for the.

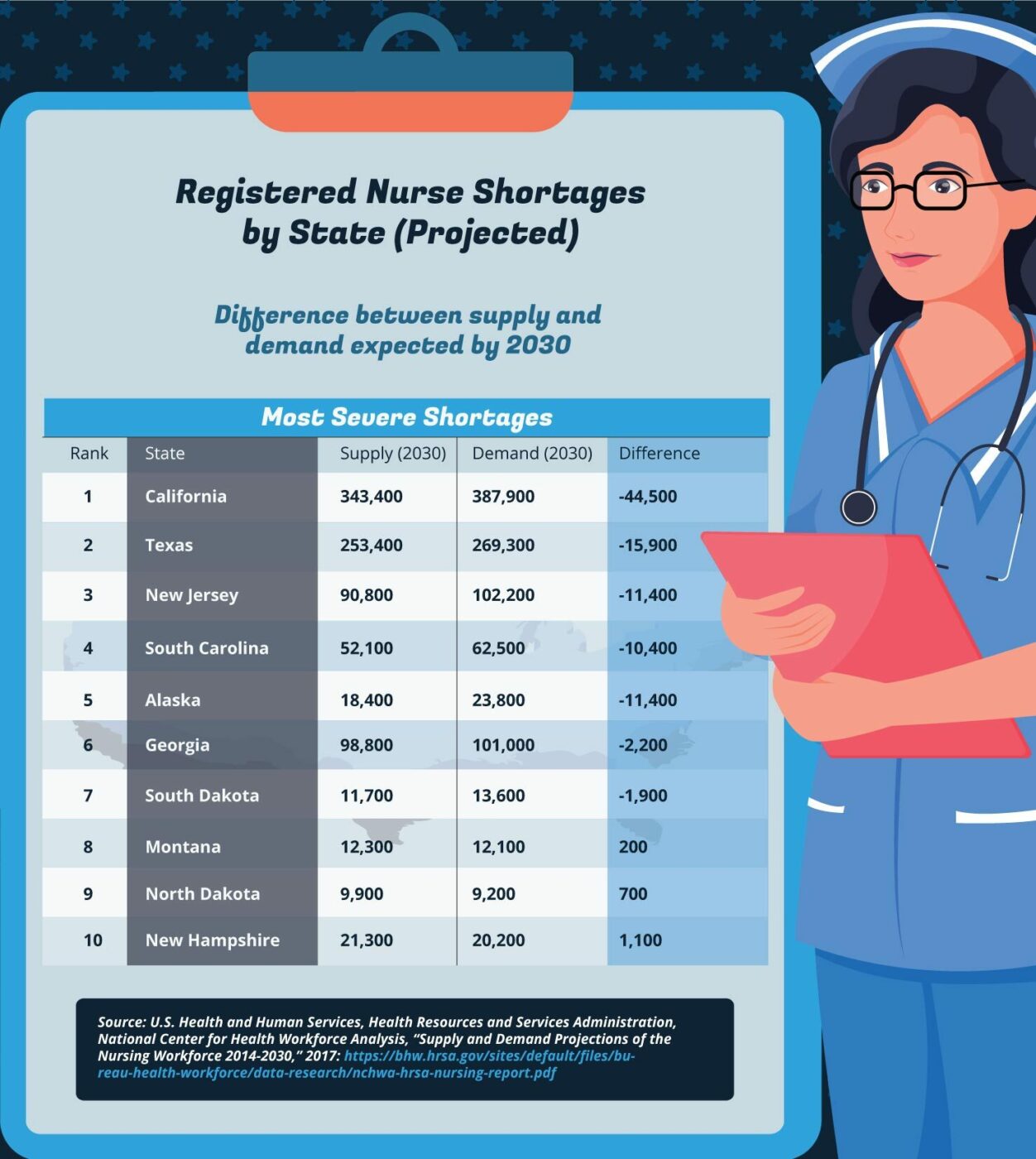

Learn more about State Tax Questions or consult a tax expert preferably a. Travel Nurse Tax Deduction 3. States have a state income tax but Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming dont.

A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. Travel nurse tax free pay. The agency that hired us said that we receive a tax free stipend based off of the GSA rate for that location of 28hr out of our 81hr rate.

Also nurses are free to go anywhere in their breaks. Travel nurses travel the nation bouncing between states and assignments. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming are the select few that will not tax income.

For more information check out the Nursing journal. Having no tax homes means they stay in hotels and hence more cost. If you travel to more than one state in a given year as a travel nurse you will be forced to file taxes in each state.

You will owe both state where applicable and federal taxes like everyone else. Where do travel nurses pay state income taxes. Utilizing a tax free stipend is incredibly important within travel nursing taxes.

First your home state will tax all income earned everywhere regardless of source. Specifically in California Tax-Free Stipends can be as much as 1800 per week for housing in San Francisco and 500 per week for Meals and Incidentals MIE. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike.

Make sure to check state laws as you may end up paying state income taxes in more than one state if you live in one but work in another. These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses. Travelers report worldwide income to their home state as full year residents and receive credits for taxes paid to other states unless a reciprocity rule applies.

Here is an example of a typical pay package. You will pay state income taxes in whichever state you work. Adding to the complexity when working in different states is the tangled web of state tax rules.

For state taxes remember to file before the April 15th deadline. The fact that the income was not earned in the home state is irrelevant. However keep in mind that the IRS generally only sees these stipends as non-taxable income if you have a tax home that is different from where youre working during your assignment.

At first glance this sounds like double taxation but this is not the case. What is a tax home. It is their job to help the client plan for the future and find ways to reduce their tax burden going forward.

As Tax Season is upon us weve prepared for you answers to the TOP 10 Tax Questions of Travel Nurses. You may be subject to state income tax in both the state of your permanent residence and the states where you had travel nurse jobs. Travel nurse earnings can have a tax advantage.

Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient when it comes to requesting extensions. FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. Travel nurse salary is different for each assignment but it generally comes with a generous hourly rate which is taxable income as well as tax-free stipends for things like housing and travel.

250 per week for meals and incidentals non-taxable. If the tax rate of the home state is higher than the work state the difference in tax must be paid to the home state. State travel tax for Travel Nurses.

If you live in Michigan and travel to Maine then New York in any given year you have to file three separate tax returns. With the exception of 9 states Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming each state taxes wages according to its own set of tax rules and as a travel nurse you may need to file a nonresident state tax return in each. File residence tax returns in your home state.

Every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in and the state thats their permanent tax home. If you need more time feel free to ask for it. Travel Nursing Tax Deduction 2.

Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses. The fact that one does not work at home does not change this. At the same time the work state will tax the income earned there.

Everything You Need To Understand About Traveling Nursing Taxes

Nursing Compact States Map Info Travelnursing Org

Is Travel Nursing Worth It Your Complete Guide Trusted Nurse Staffing

All You Need To Know About Travel Nursing Infographic

What S The Difference Between W2 And 1099 For Travel Nurses Travel Nursing Travel Nurse Jobs Nurse

How To Travel The World As An International Travel Nurse

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Updated Map Enhanced Nursing Licensure Compact Enlc April 2019 Nurse Org Nursing License Nursing Compact States Nurse

Trusted Event Travel Nurse Taxes 101 Youtube

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

What Is Travel Nursing Academia Labs

Understanding Travel Nursing Taxes Travel Nursing Filing Taxes Tax Guide Travel Nursing

How To Become A Travel Nurse 5 Requirements 2022

How To Make The Most Money As A Travel Nurse

Choosing A Healthcare Staffing Agency A Guide For Travel Nurses

Travel Nurses Are In High Demand Are You Eligible To Travel Travel Nursing Travel Nursing Companies Nurse

Travel Nurse Taxes How To Get The Highest Return Next Move Inc