real estate tax shelter act 1986

The Economic Recovery Tax Act of 1981 accelerated depreciation of commercial and noncommercial real estate making those investments more attractive. In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act.

Capital Gains Implications Of Gifts Other Transactions

Education and professional enrichment programs are developed implemented or.

. Real Estate and the Tax Reform Act of 1986. Within the broad aggregate however widely different impacts are to be. Destroying real estate through the tax code.

THE DOOR CLOSES ON TAX-MOTIVATED INVESTMENTS Olivia S. Tax and sewer payments checks only. 2085 enacted October 22 1986 to simplify the income tax code broaden the tax base and eliminate.

To pay your sewer bill on line click here. Tax Reform Act 1 of 1986 Richard A. The Tax Reform Act of 1986 was.

Property investors seeking a tax shelter pre-1986 TRA would have sought. Tax Reform Act of 1986 by Cordato Roy E. Jersey City New Jersey 07302.

The Liberty Board of REALTORS is concerned that the Jersey City Council has been reacting to. While the Code has been totally revamped the investors of real estate seem to be the main target of the Act. 2085 implemented a tax code that at once swept away and reenacted its.

280 Grove Street Room 202. The 1986 Tax Reform Act has made sweeping changed in the nations tax code. INTRODUCTION The Tax Reform Act of 19861.

Again it was analyze using the prevailing market interest rate and terms commonly available at the time. A short summary of this paper. The 1986 Tax Reform Act has made sweeping changed in the nations tax code.

While the Code has been totally revamped the investors of real estate seem to be the main target of the Act. Full PDF Package Download Full PDF Package. Westin The Tax Reform Act 2 of 1986 PL.

The association meets monthly to address real property tax and assessment issues throughout New Jersey. Congress passed the Tax Reform Act of 1986 TRA PubL. The Tax Reform Act of 1986 set new limits on the amount of income that landlords could shelter by investing in rental properties.

See reviews photos directions phone numbers and more for the best Shelters in Keyport NJ. Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate. The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986.

THE AT-RISK RULES UNDER THE TAX REFORM ACf OF 1986. No cash may be dropped off at any time in a box located at the front door of Town Hall. And tax shelter partnerships with few.

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

How Did The Tcja Change The Amt Tax Policy Center

_edited.jpg)

Wandering Tax Pro Remembers The Tax Reform Act Of 1986

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

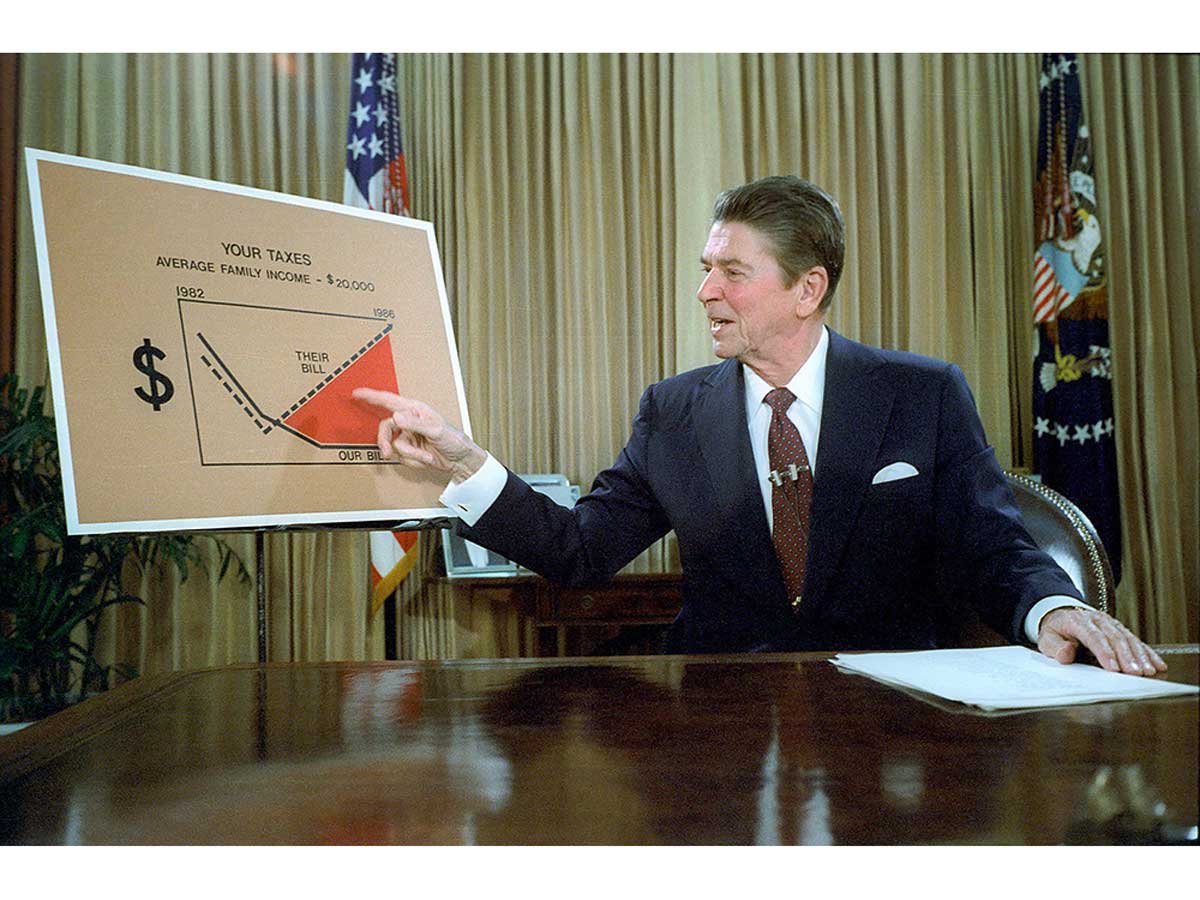

Reagans 1986 Tax Reform Act Lowered Taxes Simplified Reporting

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Rising Deficits Falling Revenues Center For American Progress

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

The Democratic Push To Tax The Rich More Is 40 Years In The Making Npr

:max_bytes(150000):strip_icc()/ronald-reagan-giving-campaign-speech-594771010-f5da44ec4ced4feeb210a728278e1885.jpg)